Export to QuickBooks (Advanced)

Easy Clocking web based software comes with a QuickBooks export feature which enables the software to create an export file containing all daily totals recorded in the Easy Clocking system. After extracting this file, it can be then be imported to QuickBooks to use this information for payroll processing.

In order to use this feature you must have some knowledge and know the procedures within QuickBooks. There are settings called service items and payroll items for each employee. A service item specifies a job the employee is performing for instance You should create a QuickBooks service item for each type of work you do for a customer, whether a partner, associate, subcontractor, or hourly employee does it. You can then use these items when filling time entries and creating invoices or checks in QuickBooks (Exporting Service Items are not required, only payroll Items are)

A payroll item is an object that QuickBooks uses for payroll calculations and reporting. Everything you track on a paycheck is tracked with a payroll item. These include hourly wages, salaries, sick time, and vacation time, federal, state, and local taxes. Payroll items are also needed for non-taxable items such as mileage reimbursements and employee loans, if you track those through payroll. When you create any kind of payroll transaction in QuickBooks—whether it’s a paycheck, a payroll tax payment, or an adjustment—QuickBooks tracks the transaction using its payroll items.

Note: Easy Clocking does not provide any training or support for QuickBooks accounting software; you must set up your QuickBooks application properly before we will support the successful transfer of daily totals from Easy Clocking software to QuickBooks software.

How to Export to QuickBooks:

STEP 1

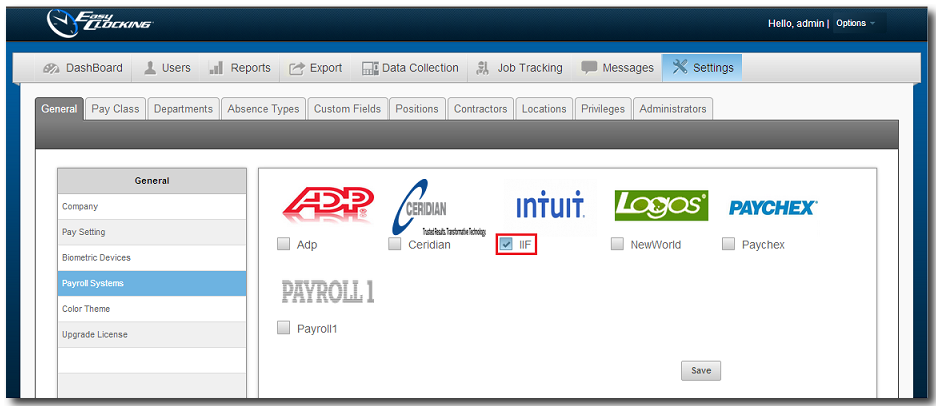

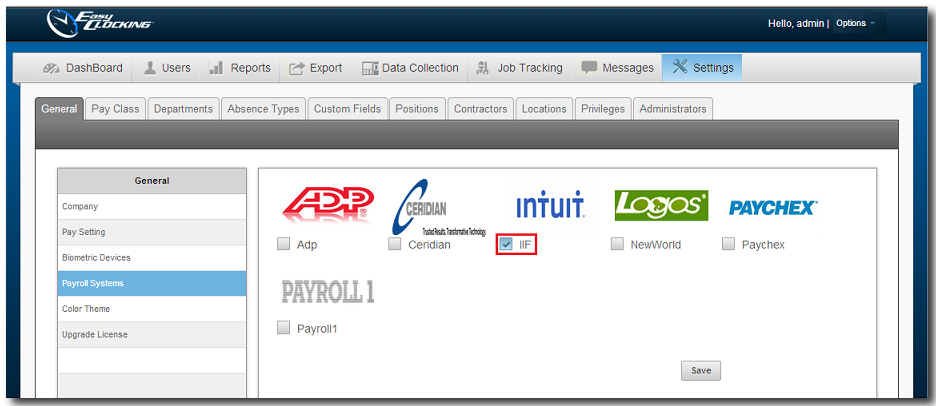

- Enable QuickBooks as the preferred payroll export by Clicking on Settings, and then click on the General.

- Click on Payroll Systems and check mark Intuit (IIF) and click Save. (See picture below)

STEP 2

Preparing to properly export data to QuickBooks.

Before exporting employees time cards to QuickBooks it’s required to ensure that the employee names on Easy Clocking are written and spelled in the same way as shown in QuickBooks. Note: if the names do not match every character, when transferring the file, blank or duplicate names will be created within the list of vendors or employees in QuickBooks.

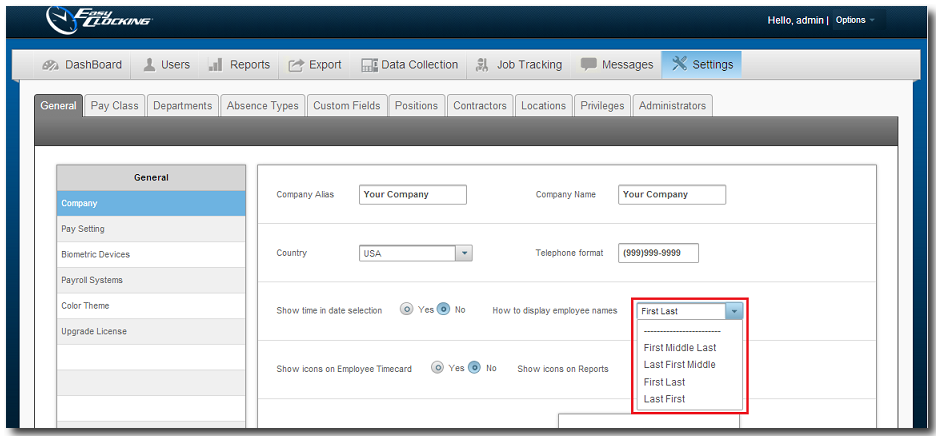

The Easy Clocking software comes preloaded with a few formats of how the names can be displayed. This will help the Easy Clocking software match the name already configured in QuickBooks.

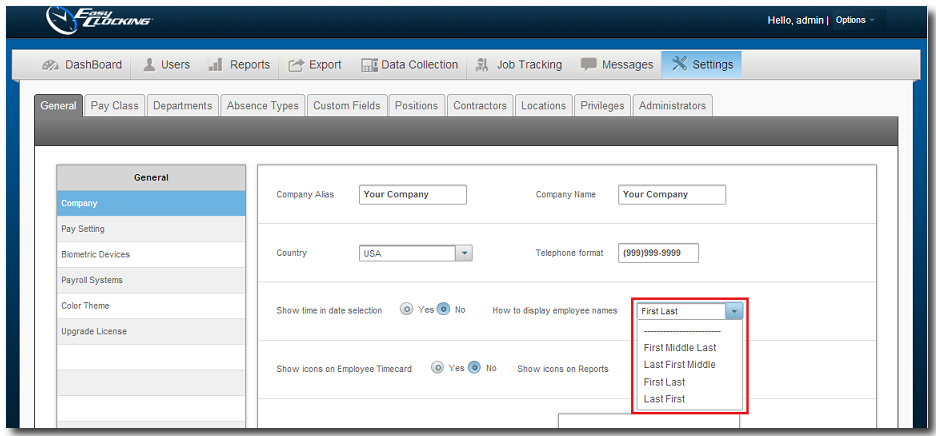

How to set the employees display name format:

- Click on the Settings tab, and then click on the General tab.

- Click on Company.

- Select the Display Name format from the drop down.

- And click Save.

Note: If the employee name in QuickBooks include a comma, period or a special character please contact our Technical Support Department for further instructions on how to export the employee’s names with this characters.

STEP 3

Configuring QuickBooks Payroll Items in Easy Clocking

In order for QuickBooks to import the IIF file from the Easy Clocking Software, each employee must be set with a Payroll Item. The payroll items in QuickBooks need to be added in Easy Clocking

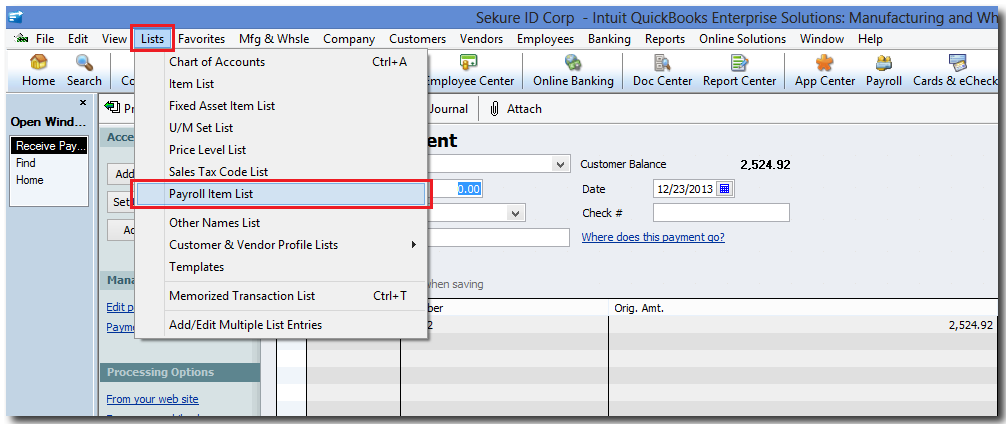

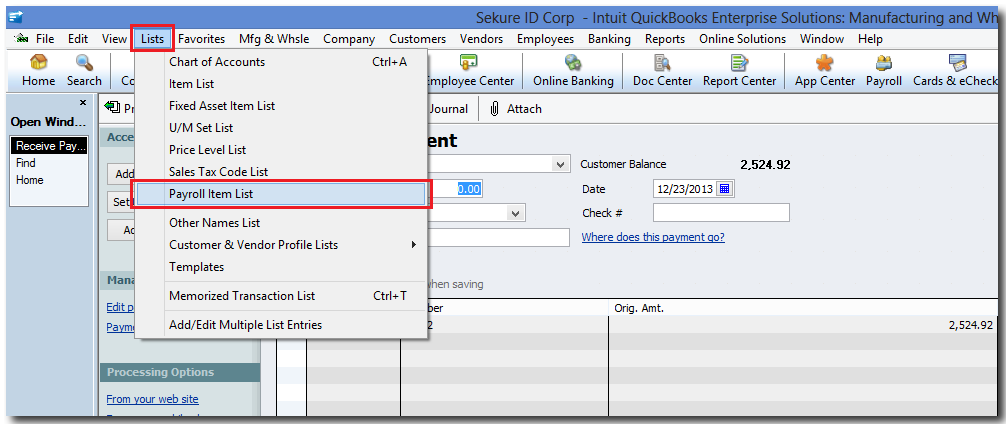

To view payroll items on QuickBooks click on the list tab and then on Payroll Item List. (See picture below)

Note: The Easy Clocking Software does not have the capabilities of handling any deductions, bonus or any items that are not part of the time & attendance tracking system.

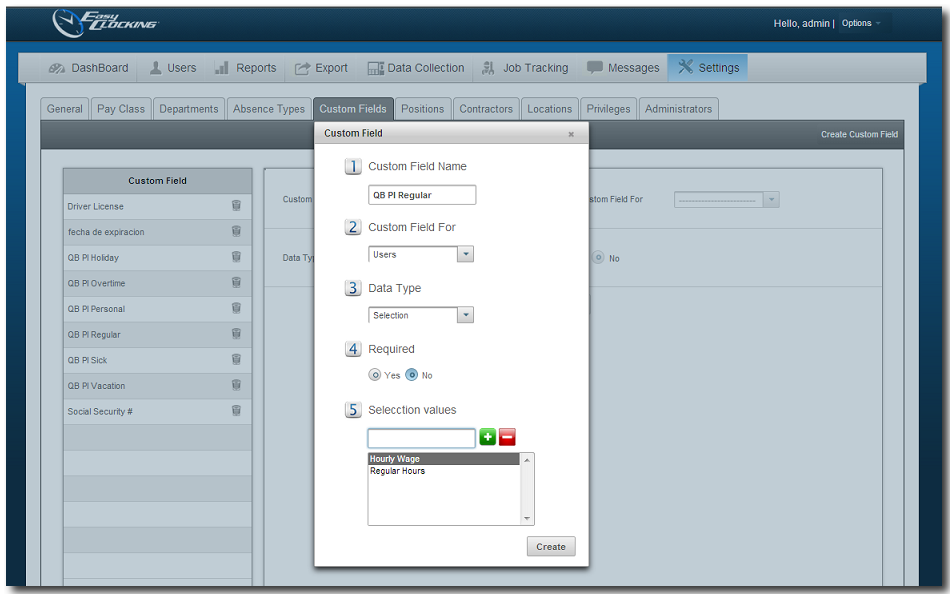

How to create the Payroll Items in the Easy Clocking software:

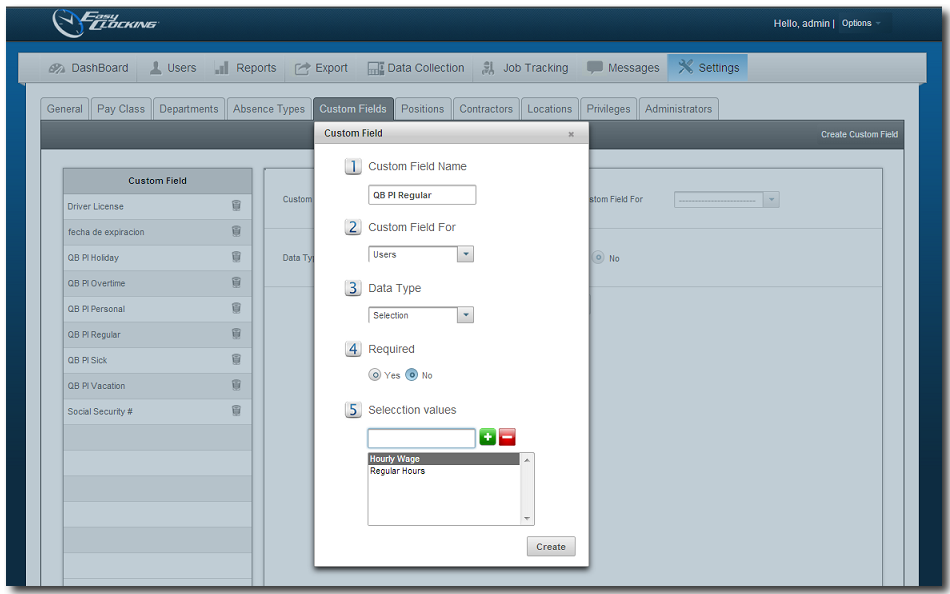

- Click on the Settings tab and then click on the Custom Fields tab.

- Click on Create Custom Field.

- You must create a custom field for each Payroll Item type you use. For example. For regular hours one payroll item is required as well as for Overtime hours, vacation hours etc. After clicking on create customer field enter the following

- Custom Field Name: QB PI Regular (This will be used for regular hours) QB PI Overtime (This will be used to transfer Overtime hours)

- Custom Field For: Users

- Data Type: Selection

- Required: No

- Selection Values: Hourly Regular. And click

to add each payroll item used in QuickBooks.

to add each payroll item used in QuickBooks. - Then click Create.

Note: The Selection Values, will be the names of the Payroll Items in QuickBooks. Make sure the payroll item name in Easy Clocking is entered exactly how it shows in QuickBooks.

Note: The Custom Field Name and Selection Values are subject to change based on the Payroll Item that is being created.

STEP 4

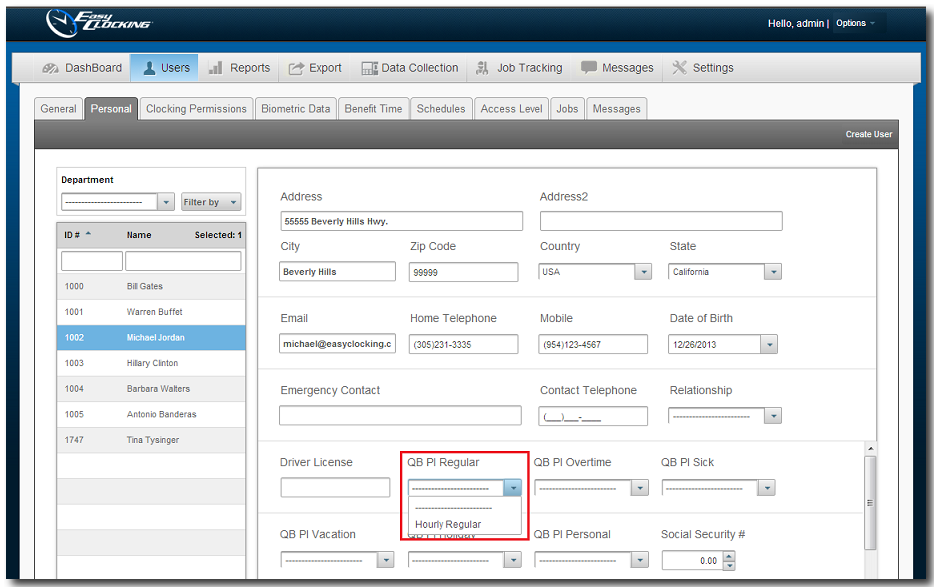

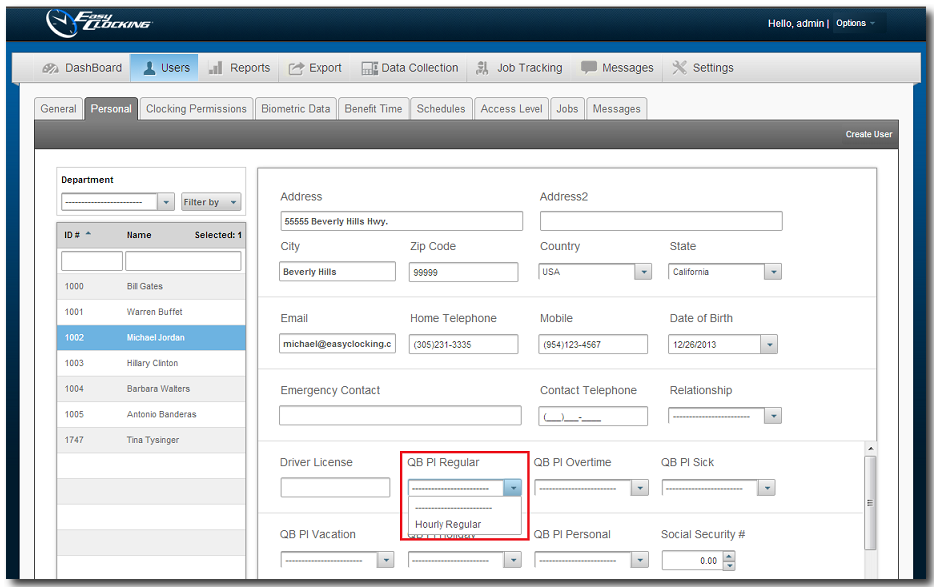

Assigning Payroll Items to Employees

Before exporting the time cards to QuickBooks, each employee must have a Payroll Item assigned on his employee profile. This payroll items has to match with the payroll assigned to the employees in QuickBooks. If the items have not been added to the employee profile in QuickBooks the hours for that particular employee will not be imported.

How to assign the Payroll Items to employees:

- Click on the Users tab and then click on the Personal tab

- Click on the Employee Name.

- On the right side of the screen, select the Payroll Items that apply to the particular employee.

- Then click Save.

STEP 5

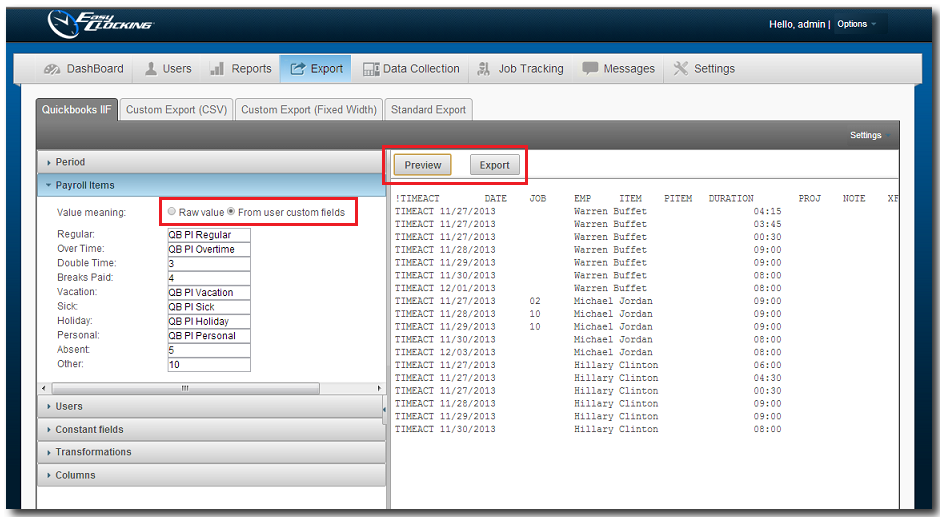

Exporting data to QuickBooks.

At the end of the week or pay period once all of the employee’s time cards have been reviewed and approved, they can be exported to QuickBooks.

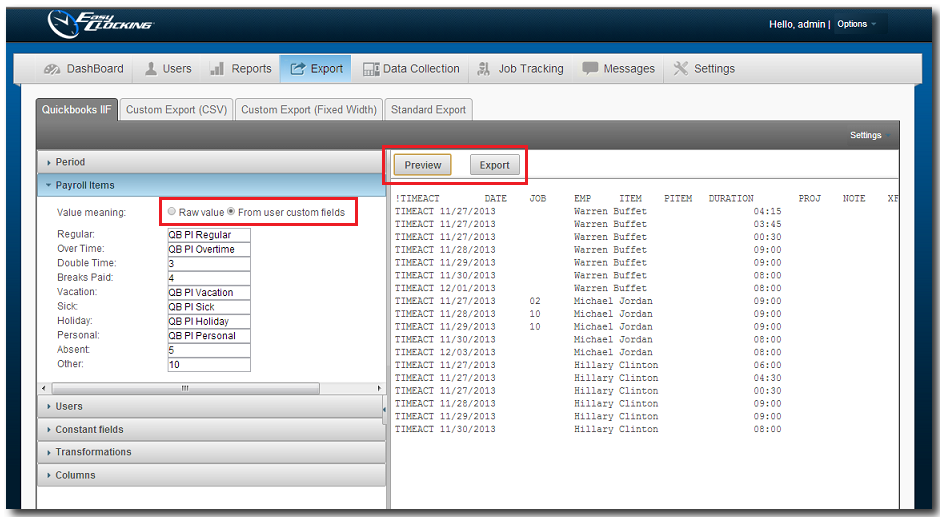

How to Create the Export (IIF) file:

- Click on the Export tab, and then click on the QuickBooks IIF tab.

- Click on Period and select the pay period to export.

- Click on Payroll Items and select the option From user custom fields.

- Enter the QuickBooks custom field name according to the custom fields. (See picture below)

- Click on Users and select one or more users from the list.

- Then click Preview to preview the file or Click Export to generate the IIF file.

Export to QuickBooks (Advanced)

Easy Clocking web based software comes with a QuickBooks export feature which enables the software to create an export file containing all daily totals recorded in the Easy Clocking system. After extracting this file, it can be then be imported to QuickBooks to use this information for payroll processing.

In order to use this feature you must have some knowledge and know the procedures within QuickBooks. There are settings called service items and payroll items for each employee. A service item specifies a job the employee is performing for instance You should create a QuickBooks service item for each type of work you do for a customer, whether a partner, associate, subcontractor, or hourly employee does it. You can then use these items when filling time entries and creating invoices or checks in QuickBooks (Exporting Service Items are not required, only payroll Items are)

A payroll item is an object that QuickBooks uses for payroll calculations and reporting. Everything you track on a paycheck is tracked with a payroll item. These include hourly wages, salaries, sick time, and vacation time, federal, state, and local taxes. Payroll items are also needed for non-taxable items such as mileage reimbursements and employee loans, if you track those through payroll. When you create any kind of payroll transaction in QuickBooks—whether it’s a paycheck, a payroll tax payment, or an adjustment—QuickBooks tracks the transaction using its payroll items.

Note: Easy Clocking does not provide any training or support for QuickBooks accounting software; you must set up your QuickBooks application properly before we will support the successful transfer of daily totals from Easy Clocking software to QuickBooks software.

How to Export to QuickBooks:

STEP 1

- Enable QuickBooks as the preferred payroll export by Clicking on Settings, and then click on the General.

- Click on Payroll Systems and check mark Intuit (IIF) and click Save. (See picture below)

STEP 2

Preparing to properly export data to QuickBooks.

Before exporting employees time cards to QuickBooks it’s required to ensure that the employee names on Easy Clocking are written and spelled in the same way as shown in QuickBooks. Note: if the names do not match every character, when transferring the file, blank or duplicate names will be created within the list of vendors or employees in QuickBooks.

The Easy Clocking software comes preloaded with a few formats of how the names can be displayed. This will help the Easy Clocking software match the name already configured in QuickBooks.

How to set the employees display name format:

- Click on the Settings tab, and then click on the General tab.

- Click on Company.

- Select the Display Name format from the drop down.

- And click Save.

Note: If the employee name in QuickBooks include a comma, period or a special character please contact our Technical Support Department for further instructions on how to export the employee’s names with this characters.

STEP 3

Configuring QuickBooks Payroll Items in Easy Clocking

In order for QuickBooks to import the IIF file from the Easy Clocking Software, each employee must be set with a Payroll Item. The payroll items in QuickBooks need to be added in Easy Clocking

To view payroll items on QuickBooks click on the list tab and then on Payroll Item List. (See picture below)

Note: The Easy Clocking Software does not have the capabilities of handling any deductions, bonus or any items that are not part of the time & attendance tracking system.

How to create the Payroll Items in the Easy Clocking software:

- Click on the Settings tab and then click on the Custom Fields tab.

- Click on Create Custom Field.

- You must create a custom field for each Payroll Item type you use. For example. For regular hours one payroll item is required as well as for Overtime hours, vacation hours etc. After clicking on create customer field enter the following

- Custom Field Name: QB PI Regular (This will be used for regular hours) QB PI Overtime (This will be used to transfer Overtime hours)

- Custom Field For: Users

- Data Type: Selection

- Required: No

- Selection Values: Hourly Regular. And click

to add each payroll item used in QuickBooks.

to add each payroll item used in QuickBooks. - Then click Create.

Note: The Selection Values, will be the names of the Payroll Items in QuickBooks. Make sure the payroll item name in Easy Clocking is entered exactly how it shows in QuickBooks.

Note: The Custom Field Name and Selection Values are subject to change based on the Payroll Item that is being created.

STEP 4

Assigning Payroll Items to Employees

Before exporting the time cards to QuickBooks, each employee must have a Payroll Item assigned on his employee profile. This payroll items has to match with the payroll assigned to the employees in QuickBooks. If the items have not been added to the employee profile in QuickBooks the hours for that particular employee will not be imported.

How to assign the Payroll Items to employees:

- Click on the Users tab and then click on the Personal tab

- Click on the Employee Name.

- On the right side of the screen, select the Payroll Items that apply to the particular employee.

- Then click Save.

STEP 5

Exporting data to QuickBooks.

At the end of the week or pay period once all of the employee’s time cards have been reviewed and approved, they can be exported to QuickBooks.

How to Create the Export (IIF) file:

- Click on the Export tab, and then click on the QuickBooks IIF tab.

- Click on Period and select the pay period to export.

- Click on Payroll Items and select the option From user custom fields.

- Enter the QuickBooks custom field name according to the custom fields. (See picture below)

- Click on Users and select one or more users from the list.

- Then click Preview to preview the file or Click Export to generate the IIF file.